Calculate self employment tax deduction

Your self-employment tax total is calculated according to your net income including wages and tips. Discover The Answers You Need Here.

Self Employed Health Insurance Deduction Healthinsurance Org

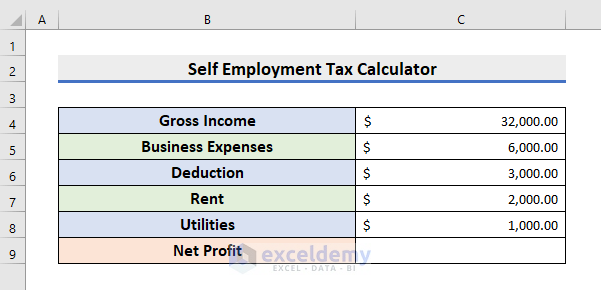

Subtract your business expenses and deductions from your gross income.

. Once youve determined how much of your net earnings from self-employment are subject to tax apply the 153 tax rate. Normally these taxes are withheld by your employer. Get a personalized recommendation tailored to your state and industry.

Use this calculator to estimate your self-employment taxes. Calculating your self-employment tax involves several steps. Ad Our clients typically receive refunds 7061 greater than the national average.

Ad Get Tips on Managing Your Taxes If Youre Recently Self-Employed. The calculator took one of these for you known as the self employment deduction. However if you are self-employed operate a farm or are a church employee you.

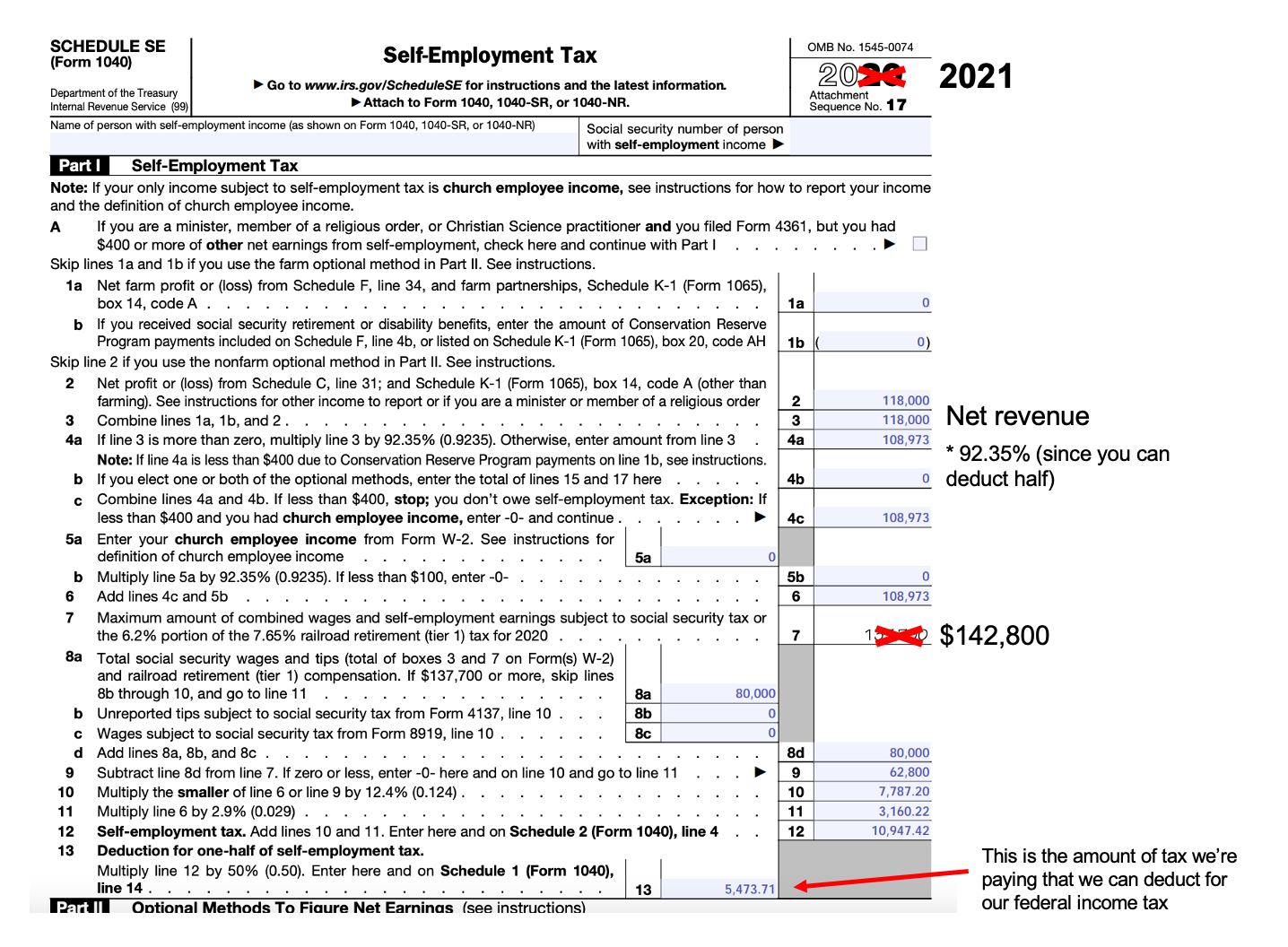

Easily Approve Automated Matching Suggestions or Make Changes and Additions. Adjusted Gross Income AGI is your net income minus above the line deductions. However you figure self-employment tax SE tax yourself using Schedule SE Form 1040 or 1040-SR.

Next to calculate your self-employment tax look for Schedule SE SE stands for self-employment. Ad Our clients typically receive refunds 7061 greater than the national average. Get a personalized recommendation tailored to your state and.

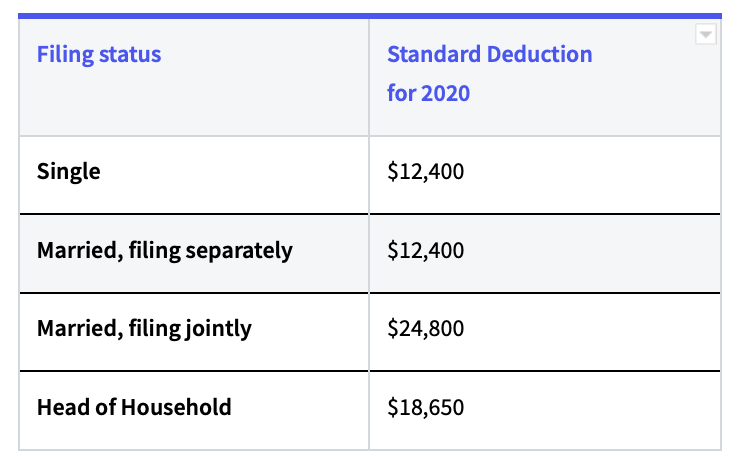

This is your total income subject to self-employment taxes. What is the self-employment tax deduction for 2020. Employers calculate Social Security and Medicare taxes of most wage earners.

Taxes Paid Filed - 100 Guarantee. That rate is the sum of a 124 Social Security tax and a 29. Here is how to calculate your quarterly taxes.

Add all net profit from your self-employment activities Multiply this amount by 09235 to account for the self. The tax rate is calculated on 9235 of your total self-employment income. The self-employment tax rate for 2021-2022 As noted the self-employment tax rate is 153 of net earnings.

You cant simply multiply your net profit on Schedule C by. Do you have your calculator ready. How to Calculate Self-Employment Tax.

In 2021 income up to 142800 were subject to the 124 tax paid for the Social Security portion of self-employment. This is your total income subject to self-employment taxesThis is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. This is calculated by taking your total net farm income or loss and net business income or loss.

Use this Self-Employment Tax Calculator to estimate your. To help you uncover tax write offs specific to your business we created a fun and engaging Self-Employed Tax Deductions Interactive Calculator that will help you uncover self. The self-employment tax rate for 2021-2022 As noted the self-employment tax rate is 153 of net earnings.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. Here are the steps to calculate this figure. Determine your net earnings.

This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. If that number is higher than. Get a personalized recommendation tailored to your state and industry.

Discover Helpful Information and Resources on Taxes From AARP. This formula works to determine employees allocations but your own contributions are more complicated. For tax purposes gross income minus business expenses net earnings Typically 9235 of your net earnings from self-employment are subject to self-employment tax Once youve calculated.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

You calculate your self-employment tax on Schedule SE and report that amount in the Other Taxes section of Form 1040. First multiply your net income by.

A Guide To Taxes For The Self Employed And Independent Contractors

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Schedule C Income Mortgagemark Com

How To Calculate Self Employment Tax In The U S With Pictures

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Self Employment Tax Everything You Need To Know Smartasset

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Calculate Self Employment Tax In The U S With Pictures

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Self Employment Calculator Youtube

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To File Self Employment Taxes Step By Step Your Guide

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps